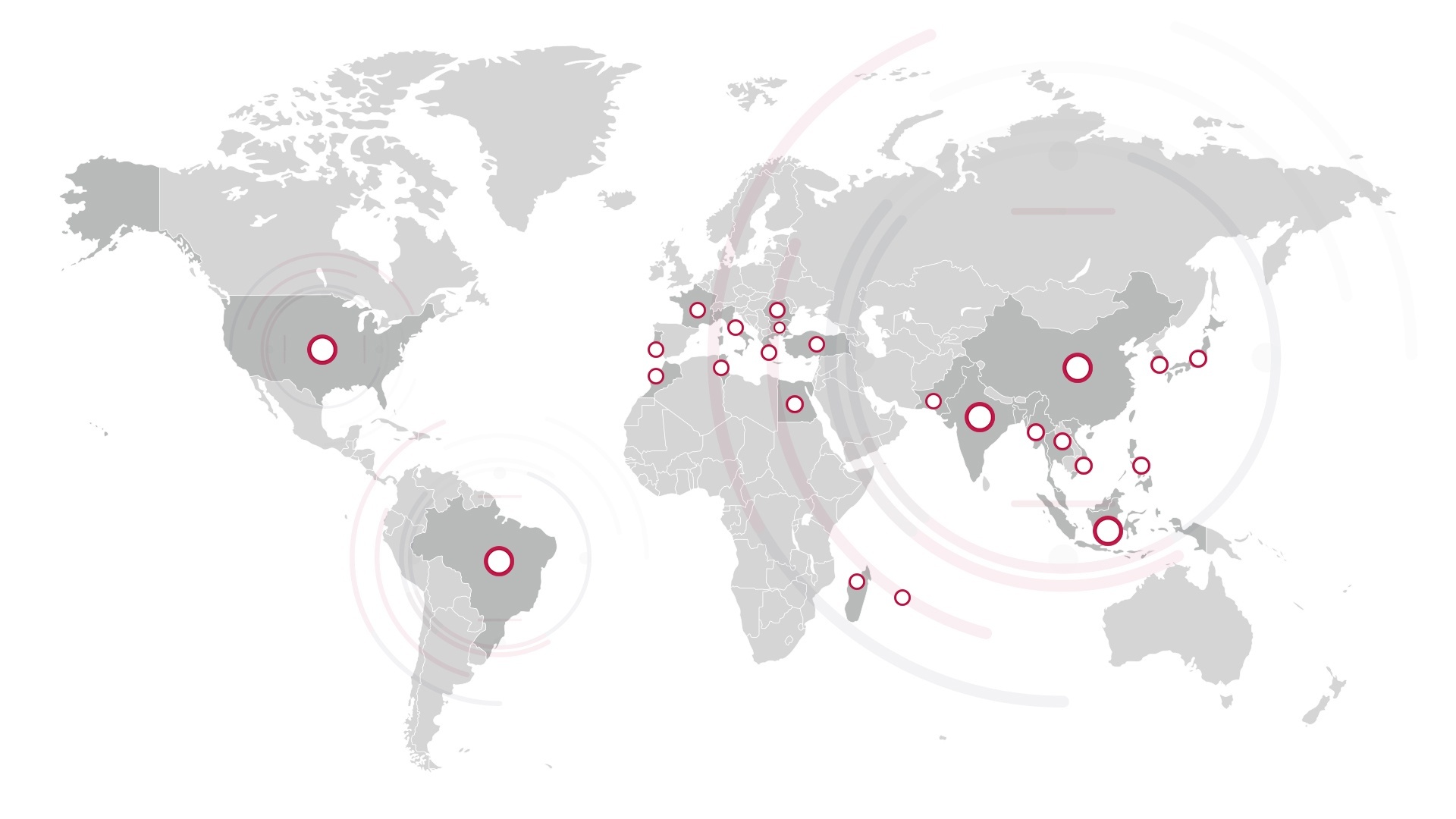

Challenges such as the US/China trade war, the current global pandemic or the heavy dependence of South East Asian countries on Chinese raw materials lead many companies to seek to diversify their pool of production countries outside of Asia. This is often in an attempt to reduce the concentration risk and its possible impact on production.

The Europe, Middle East and Africa (EMEA) area covers many attractive production clusters such as:

|

|

1. Main Advantages of Producing in the EMEA Area

The EMEA area offers many advantages for brands producing their textile, apparel and footwear goods there:

Flexibility

Delivering the possibility of small productions, and high responsiveness to small series and replenishment. These productions can also be done with tight deadlines, allowing brands to adapt to fast-evolving fashion trends and consumers’ preference.

Proximity

Being situated close to European markets, it is cheap and fast to ship goods to Continental Europe, which remains the leading destination for textile and clothing exports. The proximity to materials suppliers also allows these countries to reduce the transportation costs and time.

Labor Skills

Having good technical skills and know-how, the local workforce remains cost competitive. They are also used to working with Western markets which is reflected in their fashion sense and collection development capacities. Brands can pick and choose from suppliers’ developing collections.

Technology

Providing good technological equipment supported by regular government or industrial investment in order to grow the industry.

CSR

Ensuring compliance with social standards and concern about quality and the environment – elements that are sometimes not prioritized in other parts of the world – is key in this area.

2. Key Clusters in the EMEA Area

Eastern Europe

Eastern Europe countries such as Albania, Macedonia, Bulgaria or Romania are strengthened by their long lasting traditions in textile and clothing manufacturing. The garment sector is an important industry and the CMT (cut, make, trim) manufacturing option is the most common.

Since 2013, Eastern Europe has seen an increase of almost 30% in market value in the clothing and apparel market1, representing around 80B € in 2018.

70 – 80% of apparel are shipped to the EU with nearly half of these exports being sent to Germany.

Morocco & Tunisia

Traditionally focused on CMT work, Morocco has been playing an important role as clothing production with the rise of fast fashion and just-in-time supply chains. In 2018, the country counts 1,200 companies and textile and clothing exports represented 15% of the Moroccan industrial GDP2 with a value of 3.9B US$.

In Tunisia, 1700 textile companies contribute roughly to 3% to the country’s GDP and account for 25% of exports (mostly lingerie, swimwear and knitted items). Tunisia also produces 1/3 of the work wear, lingerie and swimwear, and jeans sold in Europe.3

Portugal

Portugal benefits from a strong leather and footwear heritage that can compete with the luxury productions in France and Italy.

The country’s textile and clothing industry thrived after 1960, when Portugal joined the EU Free Trade Association. In 2018, the industry represents 20% of employment in the manufacturing industry and 10% of the nation’s exports – equaling 5.3M€.4

Most of textile and footwear manufacturing sites are located within 100 km of Porto, the 2nd largest city in the country.

Turkey

Turkey is the 6th largest clothing supplier in the world and the 3rd largest in the European Union.5 Clothing also is the 2nd most successful export product, representing 18B US$ in 2018.

From cotton culture – Turkey is the 7th cotton producing country in the world6 – to spinning, weaving/knitting, and dyeing/finishing to garment making, the country offers the closest fully integrated textile production chain to European markets.

3. Ensuring Quality in the EMEA Area

Back to Basics: Controls to Ensure Successful Supply

Regardless of where your production is or will be based in the EMEA Area, SgT textile quality experts recommend you follow these steps to ensure successful supply.

Starting production:

- Conduct a technical audit of the factory(ies) to ensure that the skills, equipment and workforce match your requirements

- Secure bulk production launched through top or inline inspections

- Speed up product development with quality partner assistance at the factory

Increasing production:

- Investigate the origin of raw materials and trims to ensure availability and avoid supply disruption

- Evaluate the capacity of your supplier base production and if needed their sub-contracting leverage

- Monitor quality during the production volume growth through inline and final inspection

Leverage Local Presence and Expertise

Having a clear understanding of your local suppliers is key to ensuring quality products are manufactured without supply chain disruptions. However, this might be difficult if you do not know the country(ies) and their specificities – especially at times when travel is restricted.

Working with a quality partner with teams based in your sourcing countries is important as they will know about local manufacturing challenges, regulations and language as well as the best ways to collaborate with your factories. It will be easier for you to make sure that you are working with the right suppliers and have correct information on their situation.

For over 20 years, SgT has had a presence in Albania, Bulgaria, Macedonia, Morocco, Portugal, Romania, Tunisia and Turkey, visiting over 1,200 factories. Being from the locality and having worked for factories before, our textile quality experts know their country’s challenges in terms of textiles, apparel and footwear production. They can also visit any factory quickly.

.

Our local technical support solutions are tailor-made to your quality and production needs. Here is an overview of the services mentioned in this article:

- Technical audit

- Fabric & raw materials inspection

- Technical support during development

- Top, inline, final inspection

Sources:

1. https://sewport.com/top-clothing-manufacturers/europe

4. https://www.infoaid.com/wp-content/uploads/2019/09/Portuguese-TC-Industry_2019_3.2019.pdf

5. https://www.textiletoday.com.bd/overview-turkish-textiles-clothing-industry/

6. https://www.worldatlas.com/articles/top-cotton-producing-countries-in-the-world.html